Wisconsin Estimated Income Tax Voucher 1-Es Printable is a form that taxpayers in Wisconsin can use to make estimated tax payments. This form helps individuals and businesses accurately estimate and pay their state income taxes throughout the year, rather than waiting until the end of the year to pay a large sum. By using this voucher, taxpayers can avoid penalties and interest for underpayment of taxes.

It is important for taxpayers to stay compliant with their tax obligations, and using the Wisconsin Estimated Income Tax Voucher 1-Es Printable is a convenient way to do so. This form can be easily accessed and printed from the Wisconsin Department of Revenue website, making it simple for taxpayers to stay on top of their tax payments.

Wisconsin Estimated Income Tax Voucher 1-Es Printable

Wisconsin Estimated Income Tax Voucher 1-Es Printable

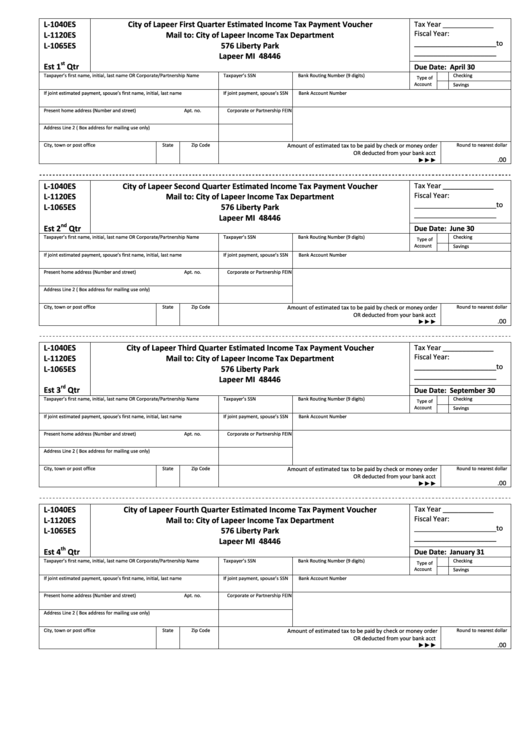

When filling out the Wisconsin Estimated Income Tax Voucher 1-Es Printable, taxpayers will need to provide their personal information, estimated income, deductions, and tax credits. Once the form is completed, taxpayers can mail it along with their payment to the Wisconsin Department of Revenue. It is important to ensure that all information is accurate and that the correct amount is submitted to avoid any issues with the tax authorities.

By using the Wisconsin Estimated Income Tax Voucher 1-Es Printable, taxpayers can take control of their tax obligations and avoid any surprises at tax time. Making estimated tax payments throughout the year can help individuals and businesses manage their cash flow and budget accordingly. It is a proactive approach to tax compliance that can save taxpayers time and money in the long run.

Overall, the Wisconsin Estimated Income Tax Voucher 1-Es Printable is a valuable tool for taxpayers in Wisconsin to accurately estimate and pay their state income taxes. By using this form, taxpayers can stay compliant with their tax obligations and avoid penalties and interest for underpayment of taxes. It is a simple and convenient way to manage tax payments throughout the year and ensure financial stability.