Keeping track of your tax expenses is crucial for maintaining financial stability and ensuring compliance with tax laws. One way to easily organize and manage your tax expenses is by using a printable tax expense sheet. This simple tool allows you to record all your expenses in one place, making it easier to calculate deductions and file your taxes accurately.

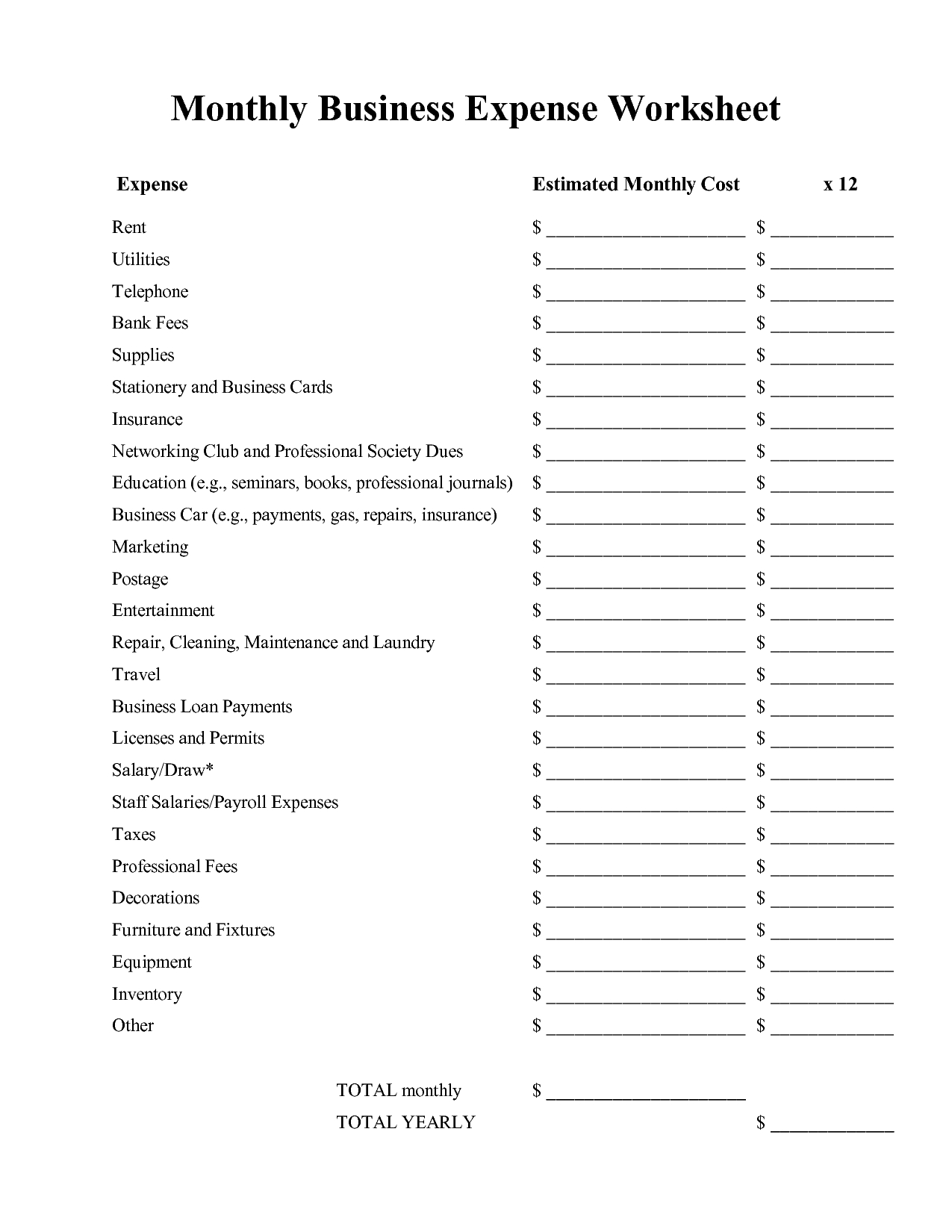

With a printable tax expense sheet, you can categorize your expenses by type, such as business expenses, medical expenses, charitable contributions, and more. This helps you keep track of where your money is going and identify potential deductions that can lower your tax liability. By recording each expense as it occurs, you can avoid the stress of scrambling to gather receipts and documents at tax time.

Using a printable tax expense sheet also helps you stay organized throughout the year. You can easily see how much you have spent in each category and identify areas where you may be overspending. This can help you make adjustments to your budget and financial habits to ensure you are staying on track with your financial goals.

Another benefit of a printable tax expense sheet is that it can serve as a valuable record-keeping tool. By documenting your expenses in one convenient location, you have a clear record of your financial transactions that can be helpful for budgeting, financial planning, and auditing purposes. This can provide peace of mind knowing that you have all your financial information in one easy-to-access place.

In conclusion, a printable tax expense sheet is a valuable tool for organizing, managing, and tracking your tax expenses. By using this simple tool, you can stay on top of your finances, identify potential deductions, and ensure accuracy when filing your taxes. Whether you are a business owner, freelancer, or individual taxpayer, a printable tax expense sheet can help simplify the tax preparation process and give you confidence in your financial management.