When it comes to filing your state income taxes in Oregon for the year 2019, having the right forms is essential. Fortunately, the Oregon Department of Revenue provides printable state income tax forms that you can easily access and fill out to meet your tax obligations. Whether you are a resident, nonresident, or part-year resident, these forms are designed to help you accurately report your income and calculate the taxes you owe.

It’s important to stay organized and keep track of all your income and deductions throughout the year to ensure a smooth tax filing process. By using the printable state income tax forms for Oregon for 2019, you can follow step-by-step instructions and guidelines to complete your tax return correctly and avoid any potential errors or delays.

Printable State Income Tax Forms For Oregon For 2019

Printable State Income Tax Forms For Oregon For 2019

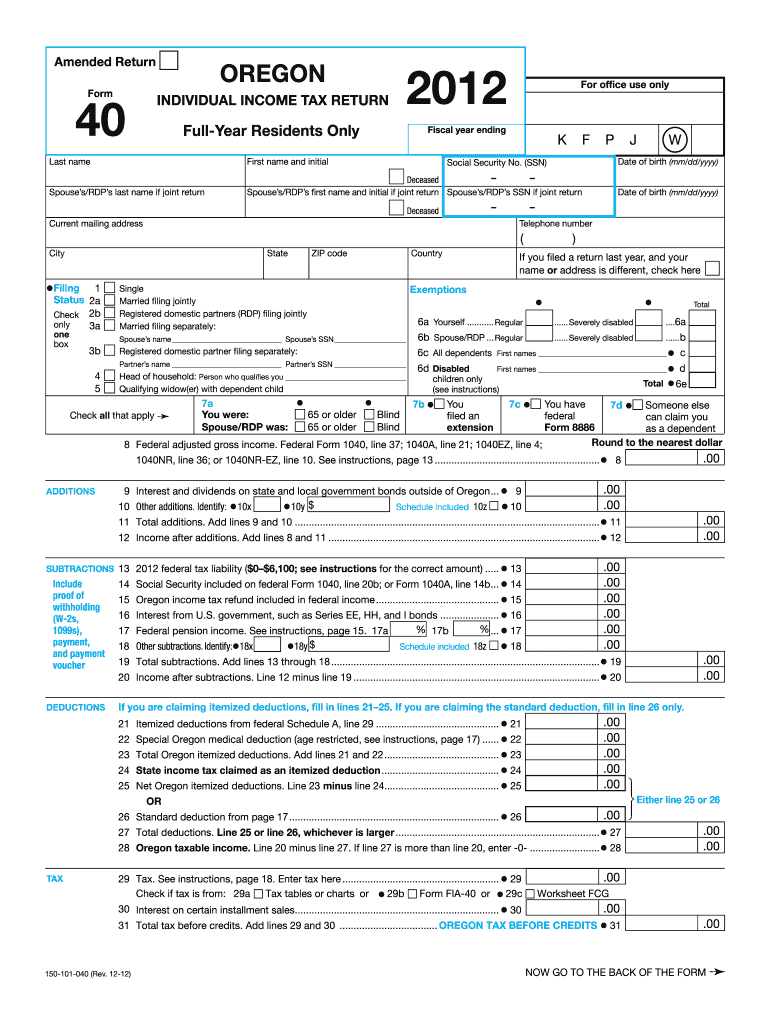

One of the most commonly used forms for state income tax filing in Oregon is the Form OR-40, which is the individual income tax return form for residents. This form allows you to report your income, deductions, and credits to determine your tax liability or refund. Additionally, there are separate forms available for nonresidents and part-year residents, such as Form OR-40-N and Form OR-40-P, respectively, to accommodate different filing situations.

When filling out the printable state income tax forms for Oregon for 2019, make sure to gather all the necessary documents, such as W-2s, 1099s, and receipts for deductions, to support the information you provide on your tax return. Double-check your entries and calculations before submitting your forms to avoid any mistakes that could result in penalties or audits from the Oregon Department of Revenue.

For taxpayers who prefer to file their state income taxes electronically, Oregon also offers an online filing option through the Oregon Revenue Online website. This convenient and secure method allows you to submit your tax return and payments online, receive instant confirmation of receipt, and track the status of your refund if applicable.

Overall, having access to printable state income tax forms for Oregon for 2019 simplifies the tax filing process and helps you fulfill your obligations as a taxpayer. Whether you choose to file by mail or electronically, it’s important to meet the deadline and submit accurate information to avoid any complications with your state income taxes.