When it comes time to file your income taxes, having the proper documentation is essential. For renters, this includes having a record of your rent payments throughout the year. One way to easily track and document your rent payments is by using printable rent receipts. These receipts can serve as proof of payment and can be used for income tax purposes.

By providing your landlord with a request for a rent receipt, you can ensure that you have the necessary documentation to support your rent payments when filing your taxes. This can help you accurately report your expenses and potentially qualify for certain deductions or credits.

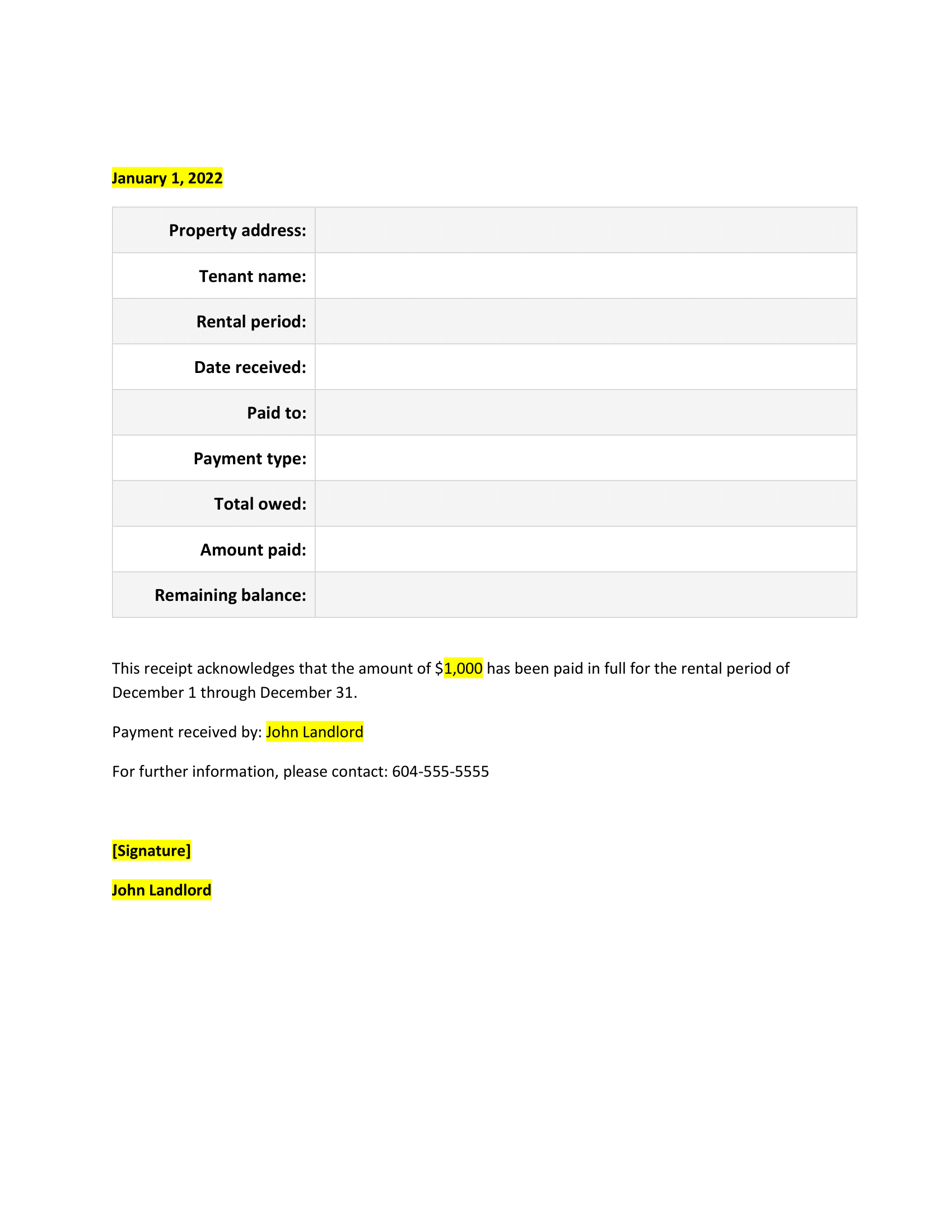

Printable Rent Receipt For Income Tax Purpose

Printable Rent Receipt For Income Tax Purpose

Printable rent receipts typically include important information such as the date, amount paid, rental period, and landlord’s information. Having this information organized and easily accessible can make the tax filing process smoother and less stressful.

It’s important to keep all of your rent receipts in a safe and organized place throughout the year. By using printable receipts, you can easily print multiple copies and keep them in a designated folder or binder. This can help you stay organized and ensure that you have all the necessary documentation when tax season rolls around.

In addition to being useful for income tax purposes, printable rent receipts can also be helpful for tracking your budget and expenses throughout the year. By keeping a record of your rent payments, you can better manage your finances and plan for future expenses.

Overall, printable rent receipts are a valuable tool for renters who want to stay organized and prepared when it comes time to file their income taxes. By keeping accurate records of your rent payments, you can ensure that you are properly reporting your expenses and potentially maximizing your tax savings.

Make sure to request a rent receipt from your landlord each time you make a payment, and consider using printable rent receipts to keep your documentation organized and easily accessible. With the right tools and preparation, you can navigate the tax filing process with confidence and peace of mind.