As tax season approaches, many Canadians start to gather their documents and prepare to file their income tax returns. In 2010, the Canadian government provided printable income tax forms to make the process easier for taxpayers. These forms allowed individuals to fill out their information and submit their taxes accurately and on time.

Printable income tax forms for the year 2010 in Canada were readily available on the official website of the Canada Revenue Agency (CRA). Taxpayers could easily access and download the forms they needed to report their income, deductions, credits, and any other relevant information required for their tax return.

Printable Income Tax Forms 2010 Canada

Printable Income Tax Forms 2010 Canada

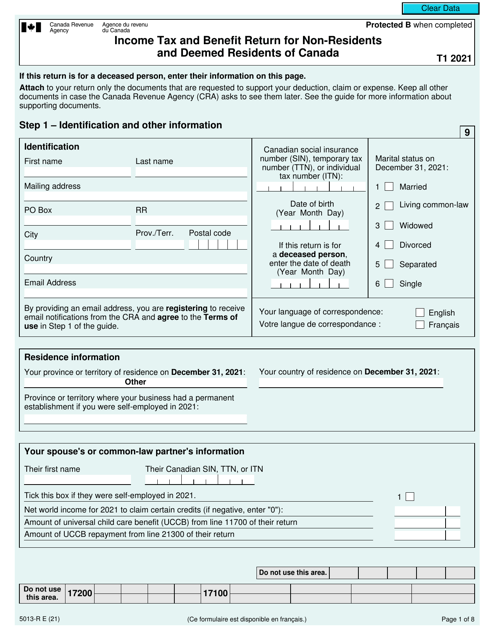

When filing taxes for the year 2010, Canadians had to ensure that they were using the correct forms specific to that tax year. The printable income tax forms for 2010 included the T1 General form, which is used by most individuals to report their income, deductions, and credits. Additionally, there were separate forms for self-employed individuals, investors, and other specific categories of taxpayers.

It was crucial for taxpayers to accurately complete their income tax forms for 2010 to avoid any delays or penalties in processing their returns. The printable forms provided a convenient way for individuals to fill out their information neatly and legibly before submitting them to the CRA. This also helped taxpayers keep track of their financial records for that tax year.

Overall, the availability of printable income tax forms for the year 2010 in Canada made it easier for individuals to fulfill their tax obligations. By using these forms, taxpayers could ensure that they were reporting their income accurately and claiming any eligible deductions or credits. As tax laws and regulations continue to evolve, having access to printable forms remains an essential tool for Canadians to meet their tax responsibilities.

In conclusion, the printable income tax forms for 2010 in Canada were a valuable resource for individuals to file their taxes efficiently and accurately. By utilizing these forms, taxpayers could ensure that they were complying with the law and taking advantage of any tax benefits available to them. As tax season approaches each year, Canadians can rely on printable forms to help them navigate the complexities of the tax system and fulfill their obligations to the government.