As a hair stylist, managing your income and expenses is crucial for the success of your business. One way to stay organized and keep track of your finances is by using a printable hair stylist income spreadsheet. This tool can help you monitor your revenue, track your expenses, and ultimately, maximize your profits.

A printable hair stylist income spreadsheet is a simple yet effective way to manage your finances. This tool allows you to input your earnings from each client, track your expenses such as product purchases and salon rent, and calculate your net profit. By regularly updating this spreadsheet, you can gain valuable insights into your business’s financial health and make informed decisions to improve your bottom line.

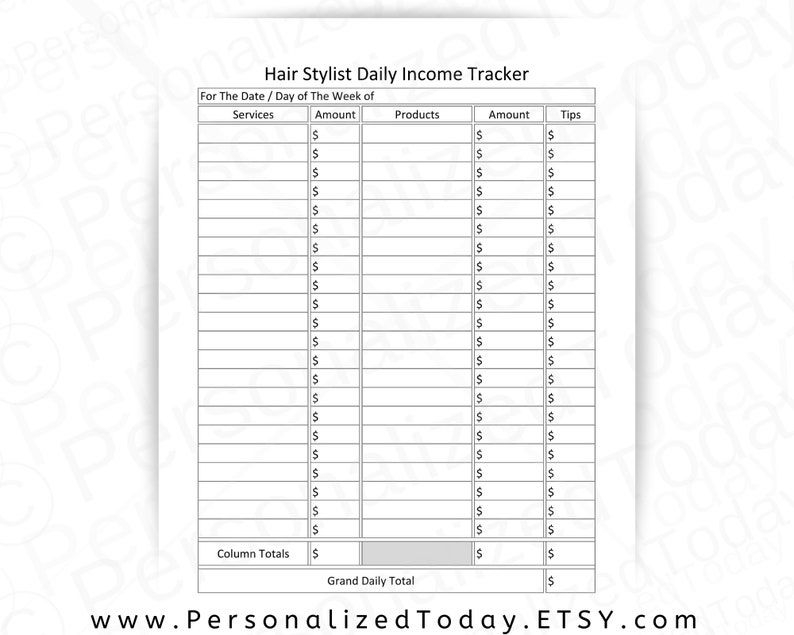

Printable Hair Stylist Income Spreadsheet

Printable Hair Stylist Income Spreadsheet

Furthermore, a printable hair stylist income spreadsheet can also help you set financial goals and monitor your progress towards achieving them. Whether you want to increase your revenue, reduce your expenses, or save for a specific investment, having a clear overview of your finances can guide your business strategy and drive your success.

In addition, using a printable hair stylist income spreadsheet can also simplify your tax preparation process. By keeping accurate records of your income and expenses throughout the year, you can easily generate reports for your accountant and ensure that you are compliant with tax regulations. This can save you time and stress when it comes to filing your taxes and help you avoid any potential penalties.

Overall, a printable hair stylist income spreadsheet is a valuable tool for any hair stylist looking to take control of their finances and grow their business. By staying organized, setting goals, and monitoring your financial performance, you can make informed decisions that will drive your success and help you achieve your business objectives.

In conclusion, a printable hair stylist income spreadsheet is a practical and efficient way to manage your finances as a hair stylist. By using this tool to track your income, expenses, and profits, you can gain valuable insights into your business’s financial health, set goals, simplify your tax preparation, and ultimately, maximize your success. So why not give it a try and see the difference it can make for your business?