Keeping track of your expenses is crucial when it comes to claiming itemized deductions on your taxes. One way to make this process easier is by using a printable expense report template. This template allows you to organize your expenses in a clear and concise manner, making it easier to calculate your deductions at the end of the year.

By using a printable expense report for itemized deductions template, you can ensure that you are capturing all of the expenses that are eligible for deduction. This can help you maximize your tax savings and avoid any potential issues with the IRS. Whether you are self-employed or have a traditional job, keeping accurate records of your expenses is essential.

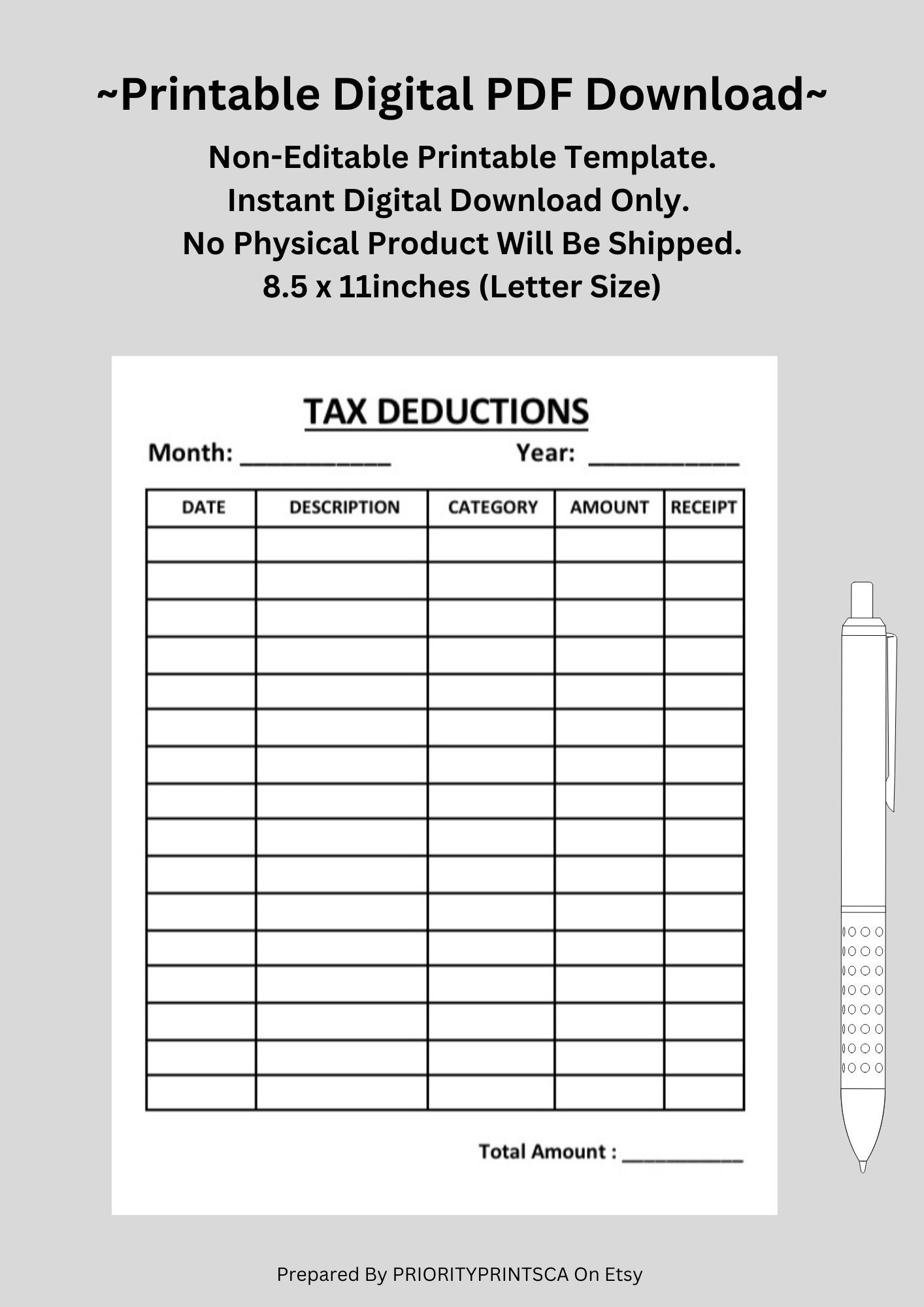

Printable Expense Report For Itemized Deductions Template

Printable Expense Report For Itemized Deductions Template

When using a printable expense report template, it is important to include all relevant information such as the date of the expense, the amount spent, the purpose of the expense, and any receipts or supporting documentation. This will help you provide a clear and detailed record of your expenses in case of an audit.

Furthermore, using a template can also save you time and effort when it comes to organizing your expenses. Instead of manually creating an expense report from scratch, you can simply fill in the template with the necessary information and have a professional-looking report ready in no time.

Overall, utilizing a printable expense report for itemized deductions template can help you stay organized, save time, and ensure that you are accurately capturing all of your deductible expenses. This can ultimately lead to a higher tax refund or lower tax liability, making it a valuable tool for anyone looking to maximize their tax savings.

In conclusion, using a printable expense report for itemized deductions template is a smart and efficient way to track your expenses and ensure that you are claiming all eligible deductions on your taxes. By keeping detailed records and using a template to organize your expenses, you can simplify the tax filing process and potentially save money in the long run.