Keeping track of client expenses is essential for any business to maintain financial transparency and accountability. Whether you are a freelancer, small business owner, or contractor, having a detailed record of client expenses can help you stay organized and ensure accurate billing.

One way to simplify the process of tracking client expenses is by using a printable client expense record. This document allows you to record all expenses related to a specific client in one convenient place, making it easy to reference when preparing invoices or reconciling accounts.

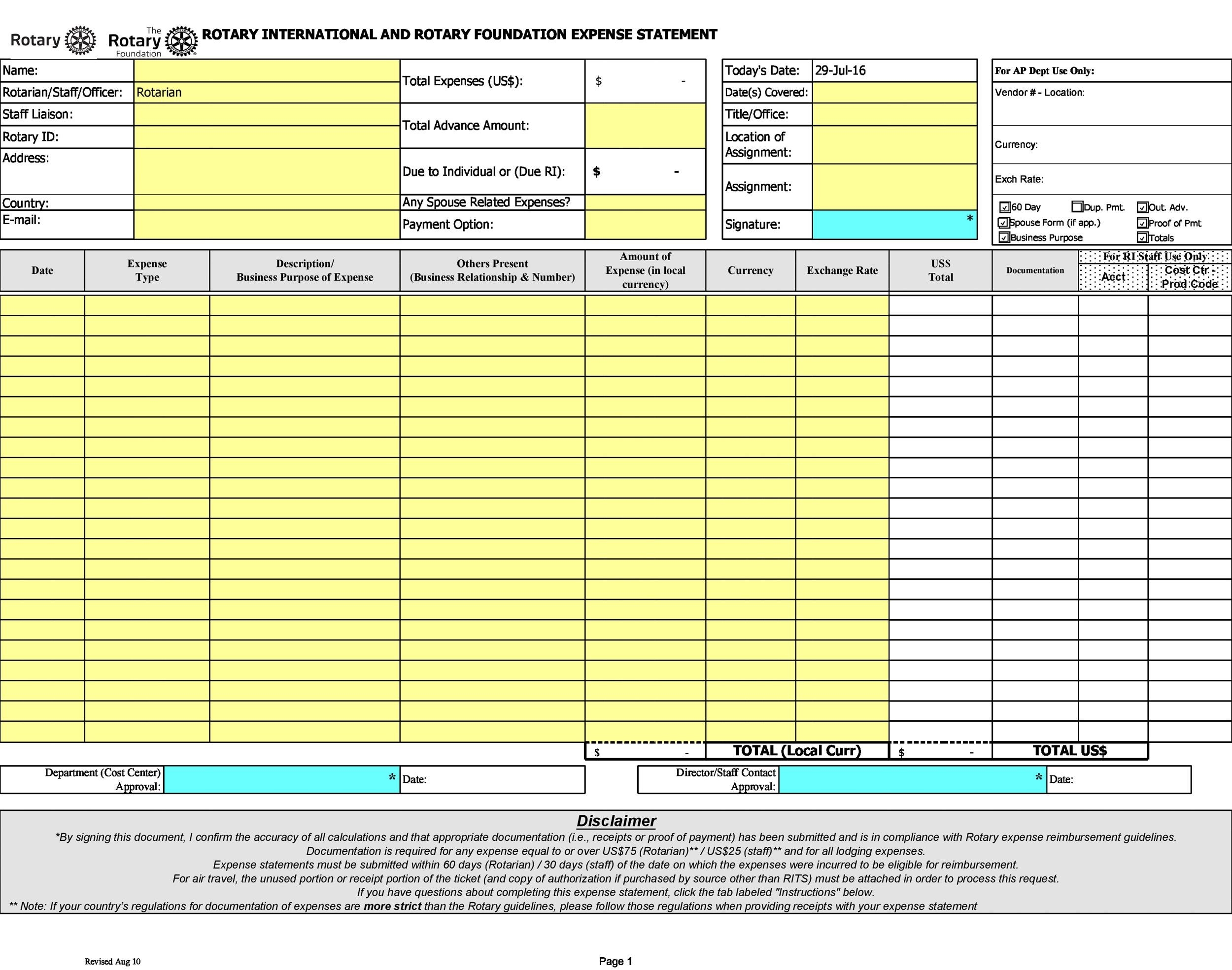

Printable Client Expense Record

Printable Client Expense Record

With a printable client expense record, you can easily track expenses such as travel costs, materials, supplies, and any other expenses incurred while working for a client. By documenting these expenses in a clear and organized manner, you can ensure that you are accurately billing your clients and maximizing your profitability.

Having a detailed client expense record can also be beneficial for tax purposes, as it provides a clear breakdown of all deductible expenses related to your client work. This can help you maximize your tax deductions and minimize your tax liability at the end of the year.

Using a printable client expense record is a simple yet effective way to streamline your expense tracking process and improve your financial management practices. By consistently updating and maintaining this document, you can ensure that you are staying on top of your client expenses and operating your business in a financially responsible manner.

In conclusion, a printable client expense record is a valuable tool for any business owner or freelancer looking to effectively track and manage client expenses. By utilizing this document, you can simplify your expense tracking process, improve your financial transparency, and maximize your profitability. Take advantage of this resource to stay organized and in control of your client expenses.