Filing taxes can be a daunting task, but having the right forms can make the process much easier. If you are a resident of Oregon, you will need to fill out Oregon income tax forms to report your earnings and calculate how much you owe in taxes. Luckily, these forms are readily available online and can be easily printed from the comfort of your own home.

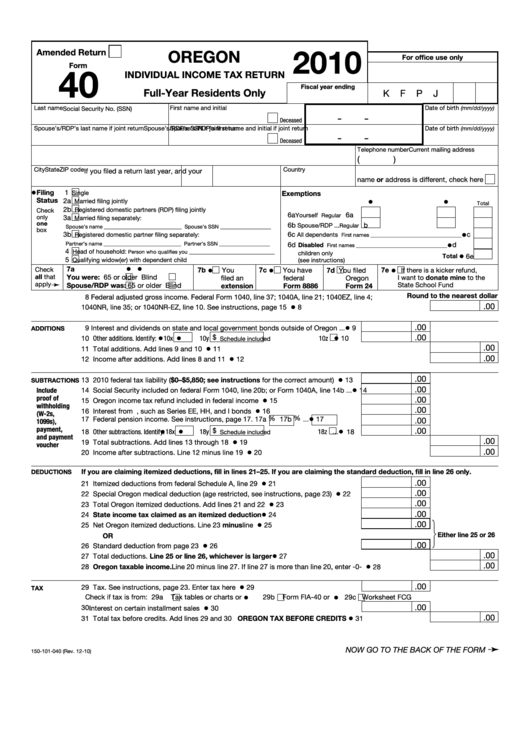

When it comes to filing your Oregon state income taxes, there are a variety of forms that you may need to fill out depending on your individual financial situation. Some of the most common forms include the Oregon Form 40, which is for full-year residents, and the Oregon Form 40P, which is for part-year residents or nonresidents with Oregon income.

Oregon Income Tax Forms Printable

Oregon Income Tax Forms Printable

In addition to these forms, there are also specific schedules and worksheets that may need to be completed depending on your sources of income and deductions. Some of these include Schedule OR-ASC for adjustments to income, Schedule OR-529 for college savings plan contributions, and Schedule OR-ASC-NP for nonresident or part-year resident adjustments.

It is important to carefully review each form and ensure that you are providing accurate information to avoid any potential issues with the Oregon Department of Revenue. By using the printable forms available online, you can take your time to fill them out accurately and double-check your work before submitting them.

Once you have completed all necessary forms, you can either file your taxes electronically or mail them to the Oregon Department of Revenue. If you choose to mail your forms, be sure to include any required documentation and send them to the appropriate address listed on the forms.

Overall, having access to Oregon income tax forms that are printable makes the process of filing your taxes much more convenient. By utilizing these forms and following the instructions carefully, you can ensure that your tax return is filed accurately and on time.

So, if you are a resident of Oregon and need to file your state income taxes, be sure to take advantage of the printable forms available online. With the right forms and attention to detail, you can make the tax filing process as smooth and stress-free as possible.