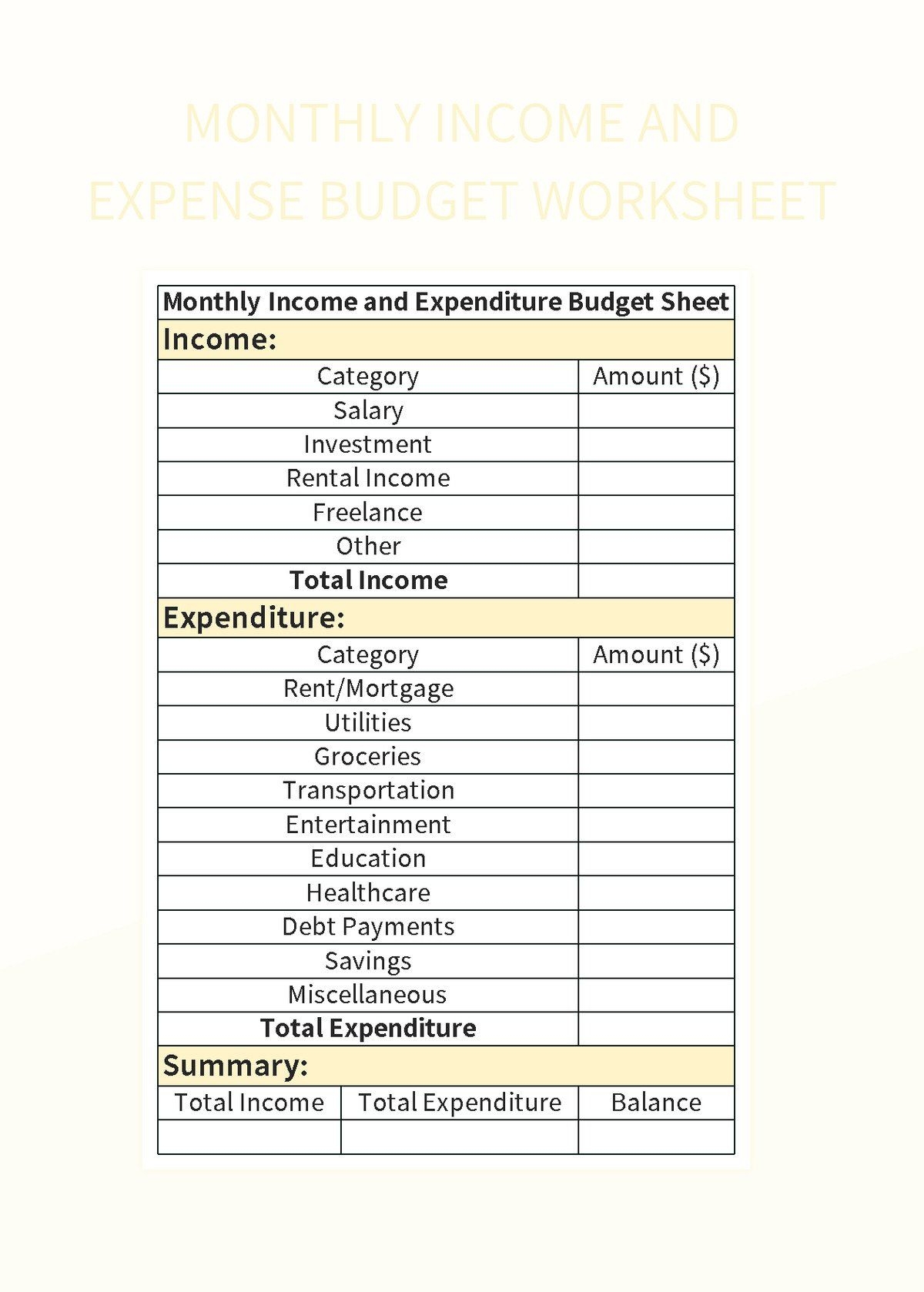

Managing your finances effectively is crucial for achieving financial stability and reaching your financial goals. One tool that can help you stay on track with your budget is a monthly income and expense printable worksheet, such as Every Dollar. This worksheet allows you to track your income and expenses, helping you to identify where your money is going and where you can make adjustments to improve your financial situation.

By using a monthly income and expense printable worksheet like Every Dollar, you can easily see how much money you have coming in each month and where your money is going. This can help you make informed decisions about your spending habits and identify areas where you can cut back in order to save more money or pay off debt more quickly.

Monthly Income And Expense Printable Worksheet Every Dollar

Monthly Income And Expense Printable Worksheet Every Dollar

One of the key benefits of using a monthly income and expense printable worksheet like Every Dollar is that it provides a clear and organized way to track your finances. You can easily input your income and expenses into the worksheet each month, allowing you to see a clear picture of your financial situation at a glance. This can help you stay accountable to your budget and make adjustments as needed to stay on track with your financial goals.

Another advantage of using a monthly income and expense printable worksheet is that it can help you set financial goals and track your progress towards achieving them. By seeing your income and expenses laid out in front of you, you can identify areas where you can save more money or increase your income in order to reach your financial goals more quickly.

In conclusion, a monthly income and expense printable worksheet like Every Dollar can be a valuable tool for managing your finances and reaching your financial goals. By tracking your income and expenses, you can make informed decisions about your spending habits, identify areas where you can cut back, and set financial goals to work towards. Consider using a printable worksheet like Every Dollar to help you stay on track with your budget and achieve financial stability.