Being self-employed comes with its own set of challenges, especially when it comes to managing business expenses. Keeping track of every penny spent is crucial for tax purposes and financial planning. Luckily, there are free printables available online that can help make this task easier for self-employed individuals.

By utilizing these printable templates, self-employed individuals can organize their expenses in a clear and efficient manner. This can help in identifying tax deductions, monitoring spending patterns, and staying on top of financial goals. Whether it’s tracking mileage, office supplies, or client invoices, there are a variety of free printables to suit different business needs.

Free Printables Self Employed Business Expenses

Free Printables Self Employed Business Expenses

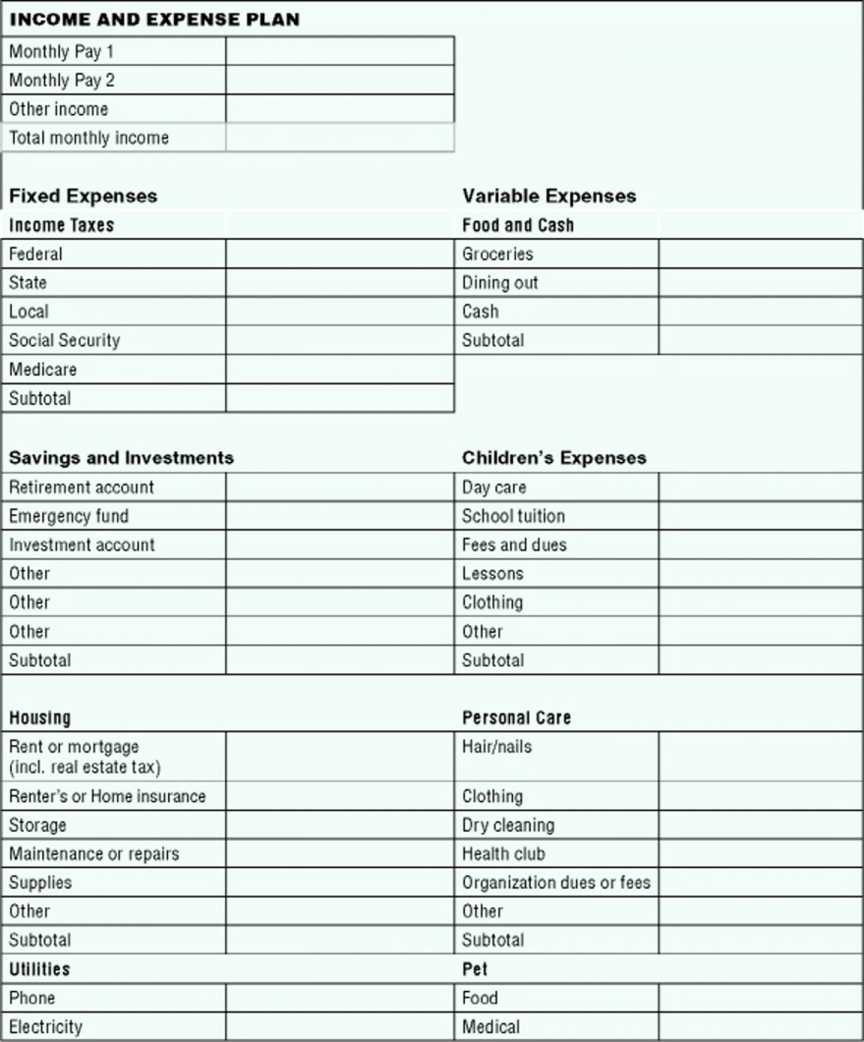

One popular printable template is the expense tracker, which allows self-employed individuals to record all business-related expenses in one place. This can include categories such as travel, meals, utilities, and more. By consistently updating this tracker, individuals can have a comprehensive overview of their spending habits and make informed financial decisions.

Another useful printable is the mileage log, which is essential for those who use their vehicles for business purposes. Keeping track of miles driven for work-related tasks can result in significant tax deductions. The mileage log printable makes it easy to record this information on a regular basis, ensuring accurate documentation for tax purposes.

For self-employed individuals who work with clients, an invoice template can be a valuable tool. This printable allows individuals to create professional-looking invoices for their services, including all relevant details such as fees, payment terms, and due dates. By using this template, individuals can streamline their invoicing process and ensure timely payments from clients.

In conclusion, free printables for self-employed business expenses can be a game-changer for individuals looking to better manage their finances. By utilizing these resources, self-employed individuals can stay organized, track expenses effectively, and maximize tax deductions. With a little effort and the right tools, managing business expenses as a self-employed individual can be made simpler and more efficient.