When it comes to filing your federal income taxes, it’s important to have the right forms on hand. One of the most commonly used forms is the 1040a, which is a simplified version of the standard 1040 form. This form is designed for individuals with less complex tax situations, making it easier to fill out and file.

Many taxpayers prefer to file their taxes electronically, but some still prefer to file by mail. For those who choose to file by mail, having a printable version of the 1040a form is essential. This allows taxpayers to easily fill out the form by hand and then mail it to the IRS for processing.

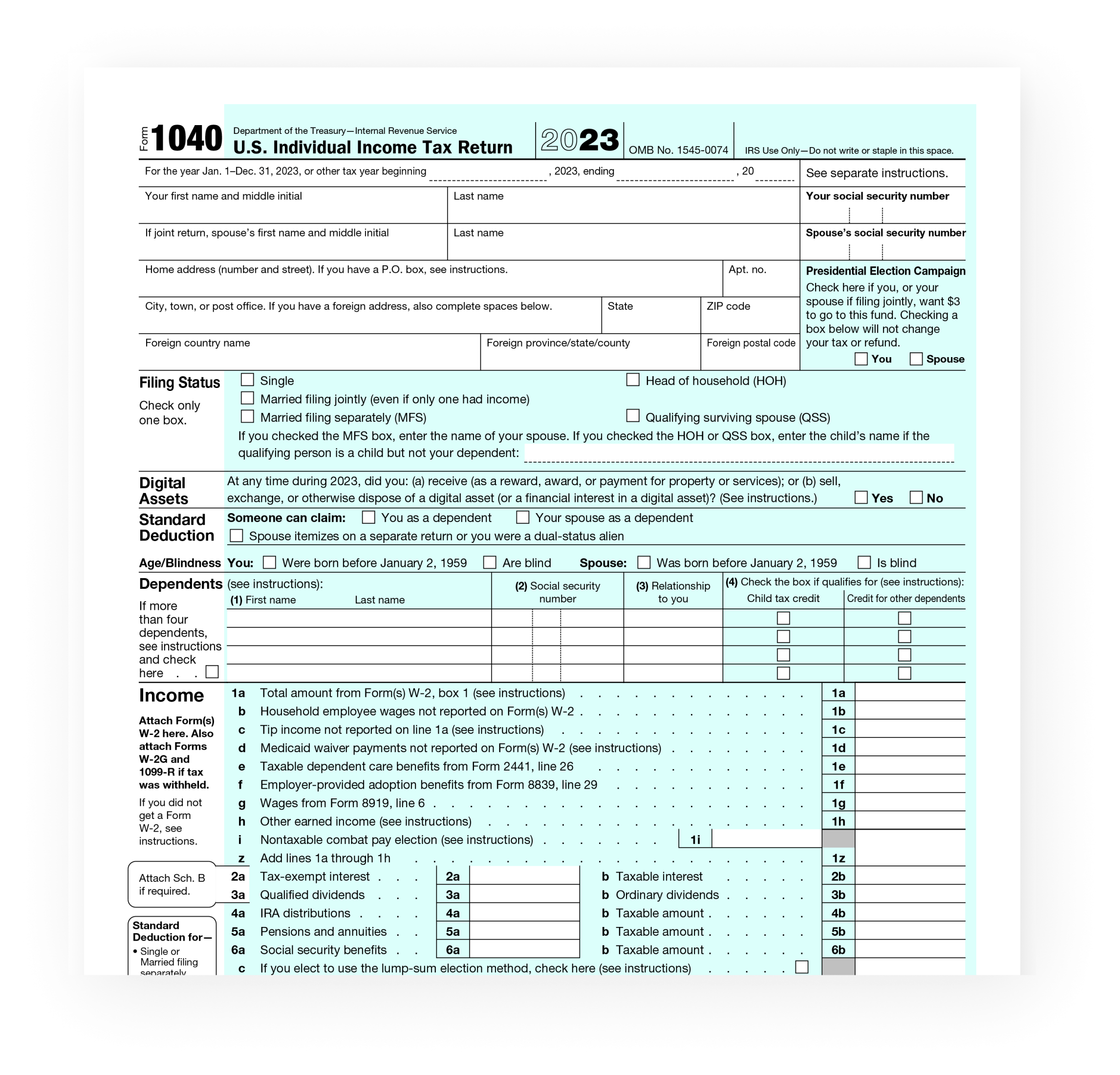

Federal Income Tax Form 1040a Printable

Federal Income Tax Form 1040a Printable

Completing the Form 1040a

When completing the 1040a form, taxpayers will need to provide information such as their income, deductions, and credits. They will also need to indicate whether they are claiming any dependents and provide information about any taxes that have already been withheld from their paychecks. Once the form is completed, taxpayers can then calculate their total tax liability and determine whether they owe additional taxes or are entitled to a refund.

One of the key advantages of using the 1040a form is that it allows taxpayers to claim certain tax credits that are not available on the standard 1040 form. These credits can help lower a taxpayer’s overall tax liability, resulting in a larger refund or lower amount owed to the IRS.

After completing the form, taxpayers should carefully review all information to ensure accuracy. Any errors or omissions could result in delays in processing or even penalties from the IRS. Once the form has been reviewed, it should be signed and dated before being mailed to the appropriate IRS address.

Overall, the 1040a form is a valuable tool for individuals with relatively simple tax situations. By providing a simplified version of the standard 1040 form, it makes it easier for taxpayers to file their taxes accurately and on time. Whether filing electronically or by mail, having a printable version of the form can help streamline the process and ensure that all necessary information is included.

So, if you’re looking to file your federal income taxes and have a relatively straightforward tax situation, consider using the 1040a form. With its user-friendly format and printable version, it’s a convenient option for many taxpayers.