It’s that time of year again – tax season. As you gather all your financial documents and prepare to file your income taxes for the year 2016, it’s important to have the necessary forms on hand. Fortunately, there are many resources available online that offer free printable forms for your convenience.

Whether you’re filing as an individual, a business owner, or a self-employed individual, having the right forms is essential to ensuring that your tax return is accurate and complete. By utilizing free printable forms, you can save time and money by avoiding the need to purchase forms from a store or pay for them online.

Free Printable Foorms For 2016 Income Tax

Free Printable Foorms For 2016 Income Tax

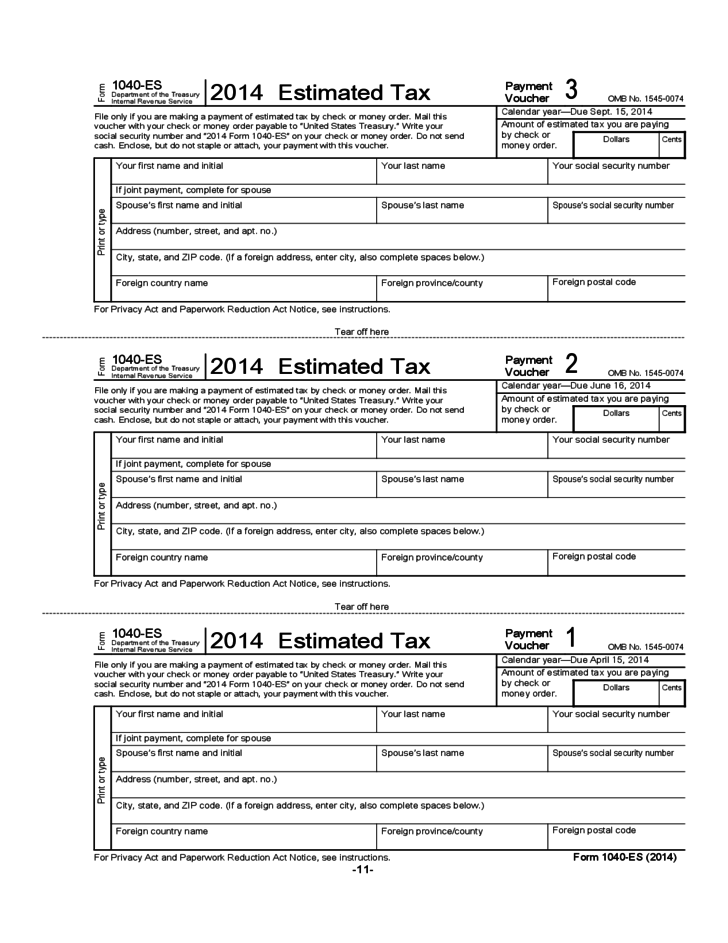

There are a variety of forms available for different types of income, deductions, and credits. Some common forms you may need for your 2016 tax return include the 1040 form for individuals, Schedule C for self-employed individuals, and various schedules for itemized deductions and credits. These forms can easily be found and printed from reputable websites such as the IRS website or other tax preparation websites.

When using free printable forms for your 2016 income tax return, it’s important to double-check that you are using the correct form for your specific tax situation. Each form has specific instructions and requirements, so be sure to carefully read through the form before filling it out. Additionally, be sure to include all necessary supporting documents and receipts to ensure that your tax return is complete.

By taking advantage of free printable forms for your 2016 income tax return, you can streamline the filing process and ensure that you are accurately reporting your income and deductions. These forms are a valuable resource for individuals and businesses alike, providing a convenient and cost-effective way to prepare and file your taxes.

As tax season approaches, be sure to take advantage of the many resources available online for free printable forms for your 2016 income tax return. By using these forms, you can simplify the filing process and ensure that your tax return is accurate and complete.