As tax season approaches, it is essential to have all the necessary forms ready to file your state income taxes. For residents of Alabama in 2014, having access to printable tax forms can make the process much easier and efficient. By having these forms on hand, you can ensure that you are accurately reporting your income and deductions to the state.

Alabama state income tax forms for the year 2014 can be easily found online and printed for your convenience. These forms are essential for individuals who earned income in Alabama during that tax year and need to report it to the state government. Having the proper forms ready can help you avoid any delays or errors in filing your taxes.

Printable 2014 Alabama State Income Tax Forms

Printable 2014 Alabama State Income Tax Forms

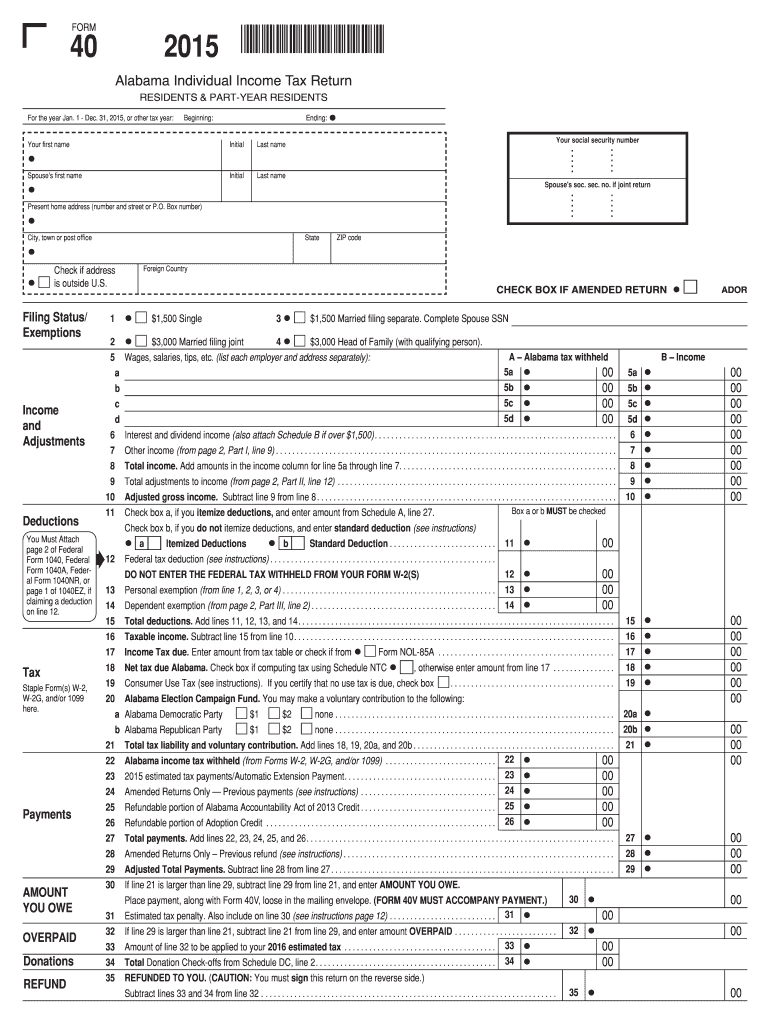

When looking for printable 2014 Alabama state income tax forms, you can visit the official website of the Alabama Department of Revenue. There, you will find a variety of forms available for download, including Form 40 (Individual Income Tax Return), Form 40NR (Nonresident Individual Income Tax Return), and Form 40X (Amended Individual Income Tax Return).

In addition to the basic tax forms, you may also need supplementary schedules and worksheets depending on your specific financial situation. These forms can help you calculate deductions, credits, and any other adjustments to your income that may impact your tax liability. By using these additional forms, you can ensure that you are taking full advantage of all available tax benefits.

Before filing your 2014 Alabama state income taxes, it is crucial to carefully review all the forms and instructions provided. Double-checking your information and calculations can help you avoid mistakes that could lead to penalties or delays in processing your return. By utilizing printable tax forms, you can have a tangible resource to refer to as you navigate the tax filing process.

In conclusion, having access to printable 2014 Alabama state income tax forms is essential for residents looking to accurately file their taxes. By utilizing these forms, individuals can ensure that they are meeting their tax obligations and taking advantage of all available deductions and credits. Be sure to gather all necessary forms and documentation before filing your taxes to streamline the process and avoid any potential errors.