As a self-employed individual, filing taxes can be a daunting task. It’s crucial to ensure that you have all the necessary forms and documents in order to accurately report your income and expenses. One of the key components of tax filing is having the right forms on hand to complete your return.

For the tax year 2018, self-employed individuals will need to gather all relevant income and expense information to accurately report their earnings. Having the correct forms can make the filing process much smoother and ensure that you are complying with all tax laws.

Printable Income Tax Forms 2018 For Self Employed

Printable Income Tax Forms 2018 For Self Employed

When it comes to printable income tax forms for self-employed individuals in 2018, there are several key documents that you will need to have on hand. These may include forms such as the Schedule C, which is used to report self-employment income and expenses, as well as any 1099 forms you may have received from clients or employers.

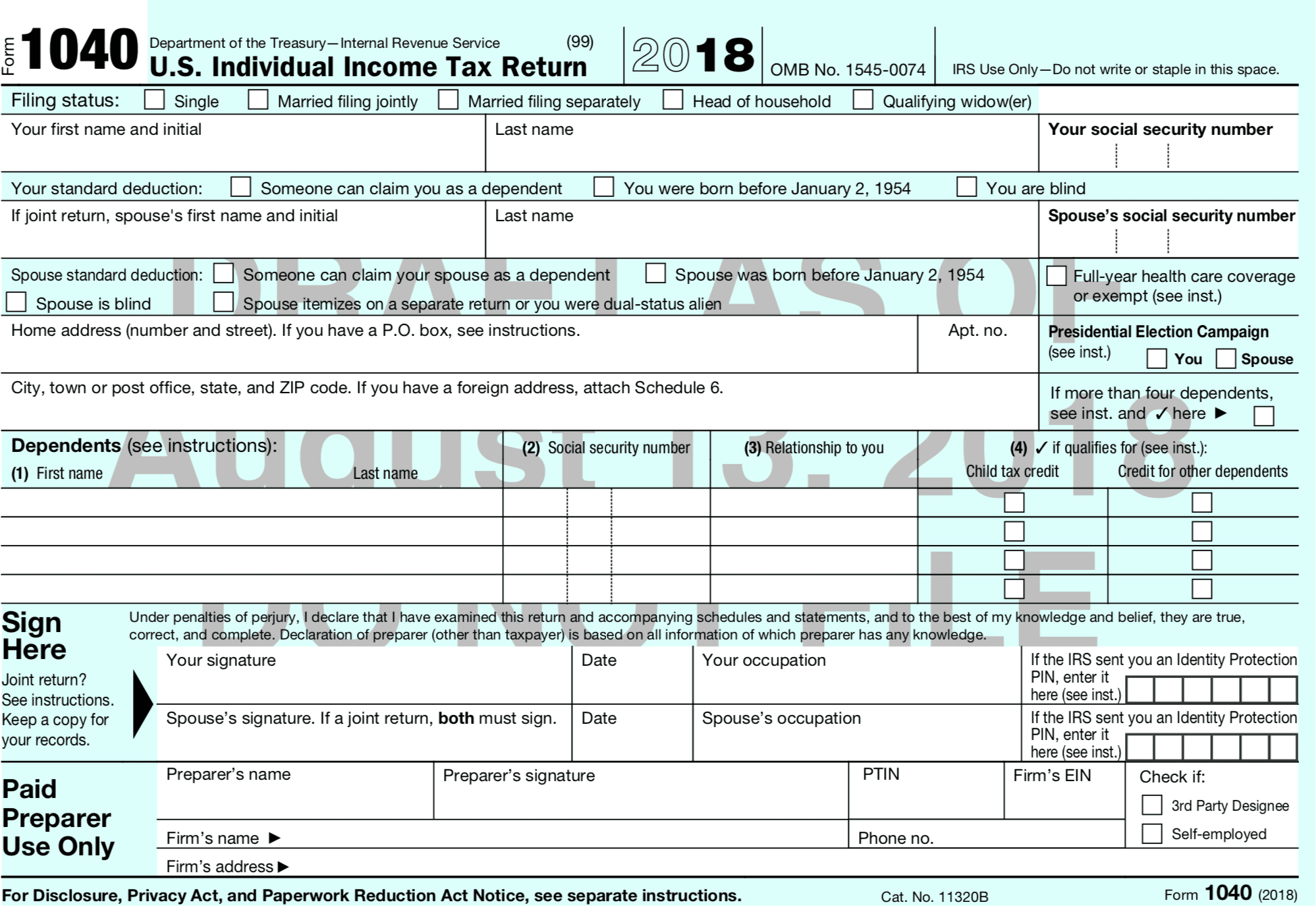

In addition to these forms, self-employed individuals may also need to fill out Form 1040, which is the standard individual tax return form. This form is used to report all income, deductions, and credits for the tax year. It’s important to ensure that you accurately report all income and expenses to avoid any potential audits or penalties.

Self-employed individuals may also need to fill out additional forms depending on their specific business structure and activities. For example, if you have employees or contractors, you may need to file additional forms such as the W-2 or 1099-MISC. It’s important to carefully review all requirements and ensure that you are filing the correct forms for your situation.

In conclusion, having the right printable income tax forms for self-employed individuals in 2018 is essential for a smooth and accurate tax filing process. By gathering all necessary documents and ensuring that you have the correct forms on hand, you can effectively report your income and expenses and avoid any potential issues with the IRS. Be sure to review all requirements and seek assistance from a tax professional if needed to ensure compliance and accuracy in your tax return.