Colorado residents who need to file their income taxes for the year 2018 can do so by using Form 104. This form is used to report an individual’s income, deductions, and credits to determine how much tax they owe or how much refund they are entitled to.

It is important for taxpayers to accurately fill out Form 104 to ensure that they are in compliance with Colorado state tax laws. The form can be downloaded and printed from the Colorado Department of Revenue website or obtained from local tax offices.

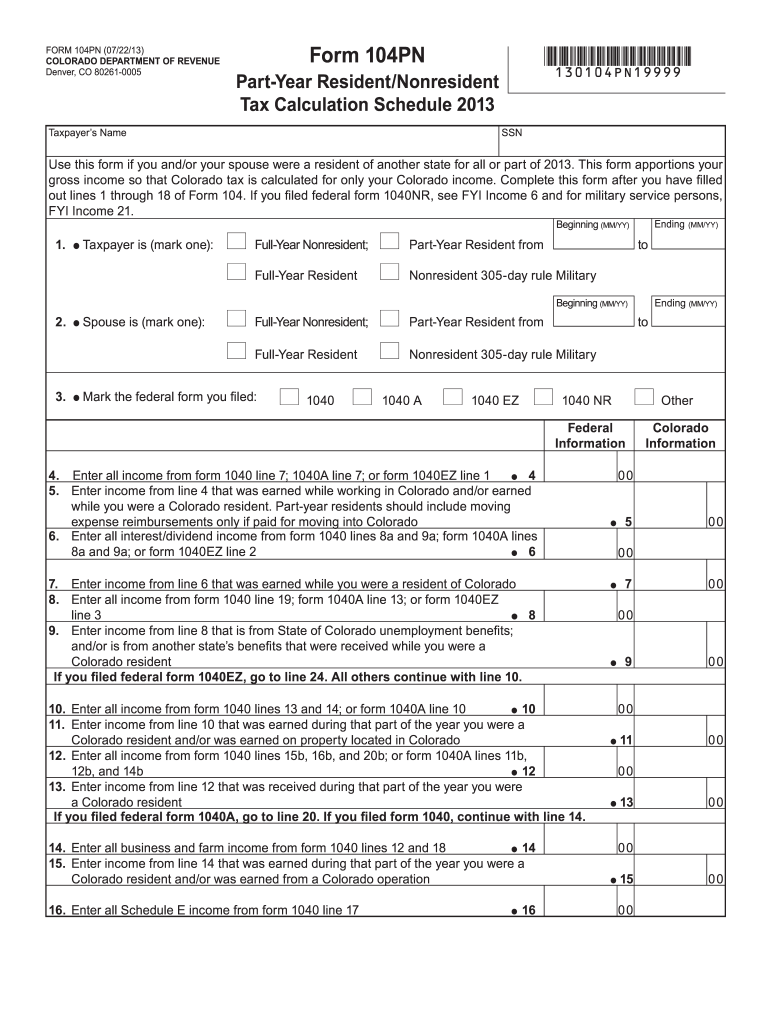

Printable Colorado Income Tax Form 104 2018

Printable Colorado Income Tax Form 104 2018

When filling out Form 104, taxpayers will need to provide information such as their personal details, income sources, deductions, and any tax credits they are eligible for. It is important to double-check all information entered on the form to avoid any errors that could delay the processing of the tax return.

Once the form is completed, taxpayers can mail it to the Colorado Department of Revenue along with any required documentation such as W-2 forms or receipts for deductions. Alternatively, taxpayers can also file their taxes online using the Colorado Department of Revenue’s electronic filing system.

After filing Form 104, taxpayers can expect to receive a notification from the Colorado Department of Revenue regarding the status of their tax return. If a refund is due, it will be issued to the taxpayer via direct deposit or by mail, depending on the payment option selected.

In conclusion, Form 104 is an essential document for Colorado residents to file their income taxes for the year 2018. By accurately completing this form and submitting it on time, taxpayers can ensure that they are in compliance with state tax laws and receive any refunds they are entitled to.