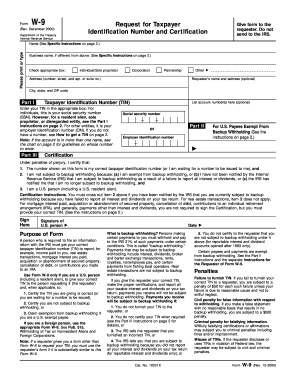

When it comes to taxes, staying organized is key. One important form that individuals and businesses may need to fill out is the W-9 form. This form is used by the United States Income Tax Bureau to collect information from taxpayers, such as their name, address, and taxpayer identification number (TIN). It is essential for anyone who receives income from various sources to be familiar with this form and its requirements.

The W-9 form is a crucial document for taxpayers to provide to payers who are required to file an information return with the IRS. This form helps ensure that the payer has the correct information needed to accurately report payments made to the IRS and to the payee. It is important to keep this form updated and on file to avoid any issues with tax reporting.

United States Income Tax Bureau W-9 Form 2016 Printable

United States Income Tax Bureau W-9 Form 2016 Printable

When filling out the W-9 form, individuals and businesses must provide their legal name, address, and TIN. If the taxpayer is a sole proprietor, they can use their Social Security Number (SSN) as their TIN. For businesses, they will need to provide their Employer Identification Number (EIN). It is important to double-check all information provided on the form to avoid any discrepancies.

The W-9 form is available for download on the United States Income Tax Bureau website as a printable PDF document. Taxpayers can easily access and print the form for their use. It is recommended to keep copies of completed W-9 forms for reference and to provide to payers as needed. By staying organized and keeping track of important tax documents, individuals and businesses can help streamline the tax reporting process.

In conclusion, the W-9 form is a vital document for taxpayers to provide accurate information to payers and the IRS. By understanding the purpose of this form and ensuring it is completed correctly, individuals and businesses can help avoid any issues with tax reporting. The printable W-9 form for 2016 is readily available for download on the United States Income Tax Bureau website, making it convenient for taxpayers to access and use as needed.