Filing income taxes can be a daunting task, but having access to fillable and printable forms can make the process much easier. For residents of West Virginia, having the right forms at your fingertips is crucial to ensuring that your taxes are filed accurately and on time.

Whether you are a full-time employee, self-employed individual, or a small business owner, having the right tax forms is essential to properly reporting your income and deductions. With fillable and printable forms, you can easily input your information, calculate your taxes, and submit them to the appropriate authorities.

Fillable And Printable 2017 West Virginia Income Tax Forms

Fillable And Printable 2017 West Virginia Income Tax Forms

When it comes to filing your 2017 West Virginia income taxes, having access to fillable and printable forms can save you time and hassle. These forms allow you to input your information directly on your computer or print them out and fill them in by hand. This can help prevent errors and ensure that your taxes are filed correctly.

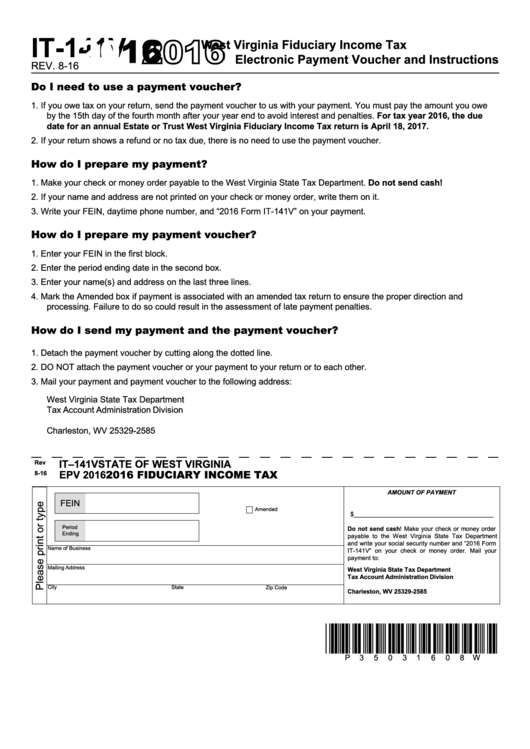

Some of the most common West Virginia income tax forms include the WV IT-140 Individual Income Tax Return, the WV IT-140V Payment Voucher, and the WV IT-140ES Estimated Tax Payment Voucher. These forms are essential for reporting your income, deductions, and any tax payments you have made throughout the year.

By utilizing fillable and printable 2017 West Virginia income tax forms, you can streamline the filing process and ensure that you are in compliance with state tax laws. These forms are readily available online through the West Virginia Department of Revenue website, making it easy to access them whenever you need to file your taxes.

Overall, having access to fillable and printable 2017 West Virginia income tax forms can make the tax filing process much simpler and more efficient. By using these forms, you can accurately report your income, deductions, and tax payments, helping you avoid potential penalties or audits. So, be sure to take advantage of these resources and make the tax filing process as smooth as possible.