As the tax season approaches, it is important for residents of Puerto Rico to be prepared with all the necessary forms to file their income taxes. Having the right forms on hand can make the process much smoother and more efficient. Fortunately, there are printable 2018 Puerto Rico income tax forms available online for easy access.

These forms are essential for individuals and businesses in Puerto Rico to report their income, deductions, and credits for the year 2018. By using the printable forms, taxpayers can ensure that they are accurately reporting their financial information and complying with the tax laws of Puerto Rico.

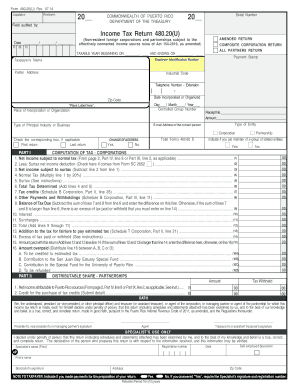

Printable 2018 Puerto Rico Income Tax Forms

Printable 2018 Puerto Rico Income Tax Forms

When looking for printable 2018 Puerto Rico income tax forms, it is important to make sure you are using the most up-to-date versions. The forms can typically be found on the official website of the Puerto Rico Department of Treasury or on reputable tax preparation websites. It is recommended to double-check the forms before filling them out to avoid any errors or delays in processing.

Some of the common forms that individuals may need to file their income taxes in Puerto Rico include Form 482, Form 480.7, and Form 480.6A. These forms cover various aspects of income reporting, deductions, and tax credits that taxpayers may be eligible for. It is important to carefully review each form and its instructions to ensure all information is accurately reported.

By utilizing printable 2018 Puerto Rico income tax forms, taxpayers can streamline the process of filing their taxes and ensure they are in compliance with the law. These forms provide a convenient and efficient way to report financial information and calculate tax liability. It is important for individuals and businesses in Puerto Rico to take advantage of these resources to meet their tax obligations.

Overall, having access to printable 2018 Puerto Rico income tax forms is essential for individuals and businesses to accurately report their financial information and fulfill their tax obligations. By using these forms, taxpayers can ensure they are in compliance with the tax laws of Puerto Rico and avoid any potential penalties or issues with their tax returns.